Australian Financial Review - Monday 12/9/2011 - Page: 20

Woodside Petroleum last tapped the market for $2.5 billion at the end of 2009 but there is a growing perception that new chief executive Peter Coleman may need to pass the can around again.

The issue is that not only has Woodside's 90 per cent share of the $2.9 billion capital expenditure at Pluto-1 overrun, but there is also less time for cash flows from the project to accumulate on the balance sheet . before Woodside embarks upon its next growth project.

Pluto-2 was once seen as a to help fund Browse as Pluto-2 cash flows would accumulate before Woodside's balance sheet was at its most stretched - just before Browse started producing.

As a result, Citigroup's Mark Greenwood told clients in a research note over the weekend that ·significant equity capital is required, or significant farmdown, or both."

With 46 per cent equity in Browse, Greenwood has calculated that Woodside would need to launch a massive $9.5 billion of equity or equity· like instruments in order to maintain FFO (funds from operations)/debt at 30 per cent and maintain its credit rating.

However, if Woodside farmed down to a 30 per cent share in Browse, Greenwood estimates the oil and gas producer would require only $1.5 billion of equity.

Moreover, he posits that even a $4 billion renounceable rights issue at $31 a share would result in dilution to Citi's discounted cash flow valuation by only 2.7 per cent or $1.31 a share.

Woodside could also reduce any equity raising required by issuing a hybrid, or by using a fully underwritten dividend reinvestment plan.

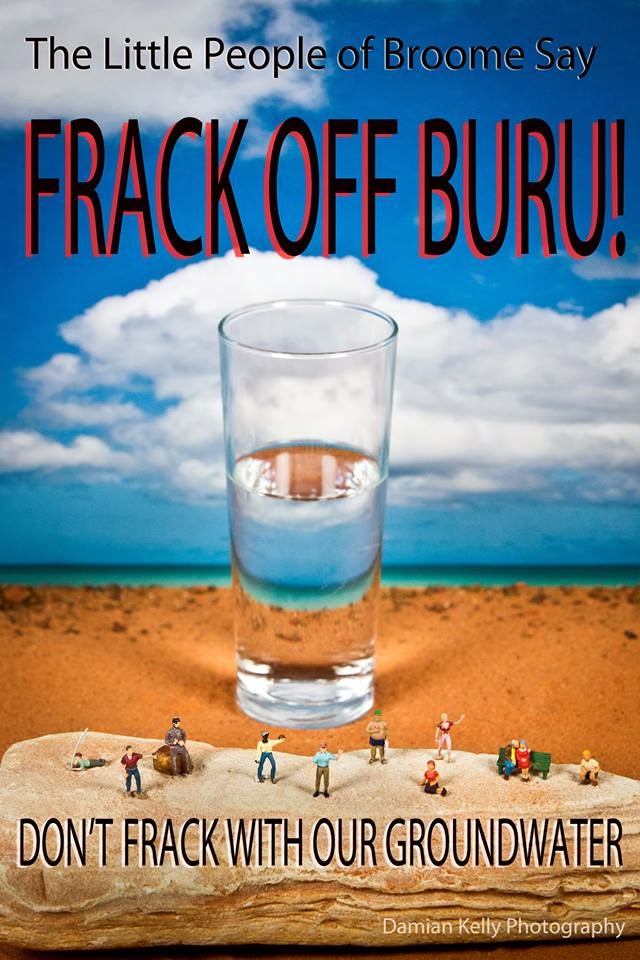

Photo Damian Kelly

Photo Damian Kelly

No comments:

Post a Comment