A MAJOR national bank has been forced to remove more than 100 misleading out of order signs from its ATMs after being targeted by anti-coal activists.

A score of ANZ Banking Group machines sprawled across six capital cities were plastered with "out of order" signs on Sunday after campaigners launched their latest bid to draw attention to the bank's funding of the coal industry.

Photo Damian Kelly

Photo Damian Kelly

Oh boy,pays to have a sense of humour all right.

ReplyDeletehttp://www.energynewsbulletin.net/storyview.asp?storyid=9592022§ionsource=s0

Beckett gets Curtin gig

Monday, 27 August 2012

THE oil and gas sector and Curtin University are set to get even closer with the appointment of Chevron’s general manager for the greater Gorgon area being appointed Curtin’s chancellor.

This is a major problem for Woodside as they try to sell JPP gas ahead of the FID.

ReplyDeletehttp://www.pennenergy.com/index/articles/newsdisplay/1731803228.html

Piyush Pandey & Boby Kurian TNN

Times of India (Electronic Edition)

August 27, 2012

Mumbai: Reliance Industries (RIL),Oil and Natural Gas Corporation (ONGC) and GAIL want to buy shares in liquefied natural gas (LNG) terminals on the east coast of the United States for shipping gas to India AT ABOUT $9.5 per million metric British thermal unit (mmBtu),WHICH WILL BE OVER 50% CHEAPER THAN CURRENT IMPORTS.Massive shale gas discoveries have made US gas-surplus,with work on converting LNG complexes from regasification to liquefaction (import to export) terminals underway.Liquefaction makes it easier to store and transport gas where pipelines are not available."Indian companies with shale gas assets are interested in acquiring an operating interest in TERMINALS TO SHIP GAS TO INDIA AT LESS THAN $10," said a banker directly involved with the discussions,adding one such deal could by finalized before year-end.India is already the world's eighth-largest importer of LNG.Those imports could rise five-fold in the next decade as domestic gas output falls and demand surges.Currently,SEVEN LNG TERMINALS are planned in the US to export gas.Indian companies want to ship from the US east coast just as Chinese counterparts focus on the west coast for shipment to ensure energy security.This is significant as natural gas shipments from US could become more viable than gas flowing from Turkmenistan through the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline in the future.The landing cost of natural gas through this pipeline is estimated at $13 per mmBtu......

I HAVE SEEN FIGURES FOR RUSSIAN GAS WELL BELOW $13 PER MMBTU,BUT THAT WAS FOR A PLAN TO PIPE INTO CHINA.

COLEMAN SAYING "THEY WILL PAY MORE FOR OUR GAS - BECAUSE IT IS BETTER QUALITY" DOESN'T SEEM TO BE HOLDING UP SO FAR.

AND INDIA HAS IT'S OWN SHALE GAS INDUSTRY JUST FIRING UP.

ReplyDeletehttp://www.pennenergy.com/index/articles/newsdisplay/1731803150.html

Dion Global Solutions Limited

August 27, 2012

India, Aug. 27 -- In a bid to mark new development, Cairn India is planning to bid for shale acreages once the bidding process starts by 2013, said the sources close to the development.

"Yes, we are keen to bid for shale acreages in India, but it is too preliminary to discuss the nature of investments we will be putting in as we need to access a lot of data before we decide on a definite strategy," a senior official told media.

THIS IS THE ONE THAT COULD REALLY CHANGE THINGS AROUND - SHALE OIL.

http://www.pennenergy.com/index/petroleum/display/6380475379/articles/pennenergy/petroleum/exploration/2012/august/strata-x-moving_forward.html

The dolomitic reservoir target of the Vail Oil Project is immediately below a world-class source rock which is interpreted to have expelled between 300 and 1,000 billion barrels of oil. To date the basin has produced about 4.3 billion barrels of oil primarily from structures above the source rock.

Strata-X recognizes direct analogies between the Elm Coulee Oil Field, located in the Williston Basin, and the Vail Oil Project. Elm Coulee has produced over 123 million barrels to date from a continuous, unconventional oil field from the Bakken dolomitic reservoir and is expected to ultimately produce over 250 million barrels of oil. The dolomitic reservoirs in both Vail and Elm Coulee are of the same geological age, have similar thickness and are immediately below highly generative source rocks.

Elm Coulee has about 4 million barrels of oil in place per section which is similar to Vail's interpreted oil in place per section. Strata-X interprets the target 50,000 net acres at the Vail Oil Project contains over 240 million barrels original oil in place (OOIP).

Oil was intersected in many historic wells at Elm Coulee but, like Vail, oil flows and recoveries were sub-commercial in the early vertical wells. More recent horizontal fracturing treatments at Elm Coulee have resulted in commercial oil flows with current production from the field is in excess of 30,000 barrels per day. Strata-X believes modern horizontal drilling and completion techniques on the Vail Oil Project will have similar commercial oil flows and recoveries as the Elm Coulee results.

OF COURSE IF THEY EVER TRIED TO BURN ALL OF IT WE WOULD ALL BE DEAD LONG BEFORE THE SUPPLIES WERE DELETED.ALONG WITH THE REST OF THE PLANET.

BUT ANYTHING THAT DRIVES A NAIL INTO WOODSCUMS ASS MAKES US ALL HAPPY.

Worst. Accent. Ever.

ReplyDeleteGoddamnit y'all

Deleteold twiggy's accent is gonna sound like his shorts are 5 sizes too small when iron ore hits this price.

ReplyDeleteserve the greedy lieing destroying sob right.

http://www.theaustralian.com.au/business/mining-energy/morgan-stanley-warns-of-iron-ore-price-fall-to-us83-per-tonne/story-e6frg9df-1226460023085

But any sustained weakness in the iron ore price would weigh on earnings and the balance sheets of Australia’s iron ore miners, including Atlas Iron and Fortescue, which analysts have warned may require more than $1bn of additional debt to complete its ramp up to 155 million tonnes a year by June.

“If the benchmark averages below $US110 a tonne for full-year 2013, we see Fortescue getting tight for funding,” said Mr Fitzpatrick.

Twiggy meets his match.

ReplyDeletehttp://yindjibarndi.org.au/yindjibarndi/?p=2632#.UDzSvERzB0A.facebook

"After two years of meddling and attacks against us in the courts, the overwhelming support of our people in recent meetings is a win for Yindjibarndi people-power against the divisive and under-handed tactics of FMG. I hope the Yindjibarndi voice in both these meetings sends a message to Fortescue, and they come back to us with a fair agreement in line with standards already set by other more responsible companies we are working with"

http://processengineering.theengineer.co.uk/oil-and-gas/woodside-places-pluto-expansion-on-hold/1013692.article

ReplyDeleteWoodside Petroleum, Australia’s largest oil and gas company, said it will shelve plans to expand the Pluto liquefied natural gas plant after recent gas exploration attempts failed.

Pluto LNG processes gas from the Pluto and Xena gas fields, located in the Carnarvon Basin, and was approved for development in July 2007,

However, three of the four wells drilled were unsuccessful meaning a final investment decision to expand the plant has been put off.

Apparently Coleman made some statements to shareholders yesterday about expansion at Browse,but can't find the articles without a paywall.Maybe later.

http://www.lngjournal.com/lng/index.php?option=com_k2&view=item&id=3524:leading-australian-lng-producer-woodside-gives-upbeat-message-on-expansion-plans&Itemid=47

Tuesday, 28 August 2012

Woodside Chief Executive Peter Coleman told shareholders that his company as operator of six of the seven LNG processing Trains in Australia has serious growth plans at home and abroad.

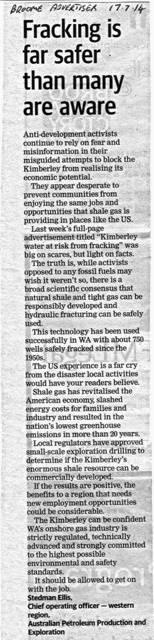

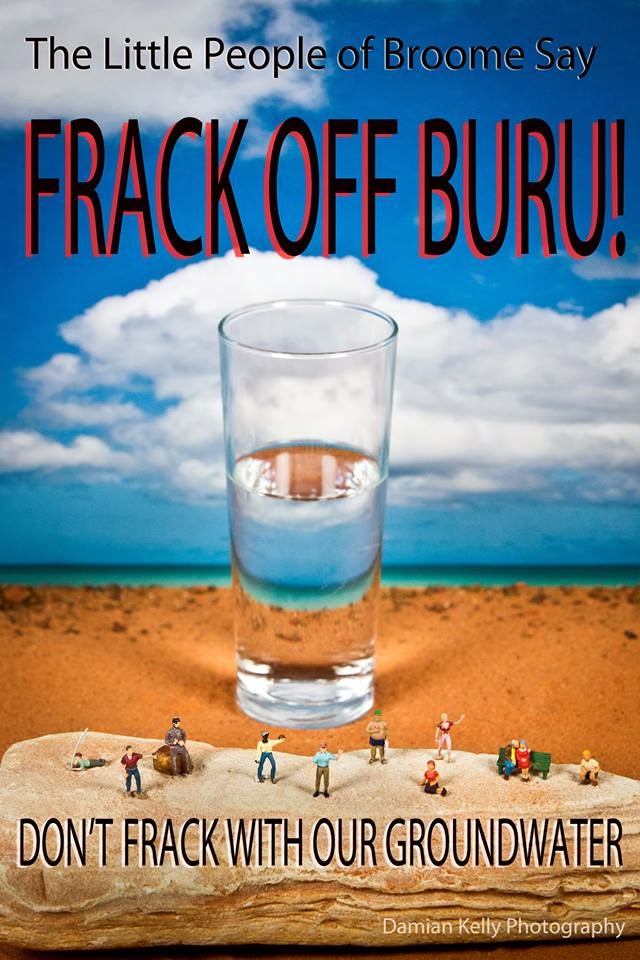

Will we ever really know how they are poisoning us?

ReplyDeletehttp://www.abc.net.au/news/2012-08-29/fracking-in-wa-to-be-more-tightly-regulated/4231348?section=wa

Resource companies will be required to tell the State Government which chemicals they inject into the ground to release gas.

But will the state gov tell us?

This could be nasty - especially for Barnett and Twiggy.

ReplyDeletehttp://www.theaustralian.com.au/business/mining-energy/iron-ore-price-continues-to-slide-as-chinese-steel-mills-solder-on/story-e6frg9df-1226461161820?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+TheAustralianBusinessHome+(The+Australian+%7C+Business+%7C+Homepage)&utm_content=Google+Reader

Prices of iron ore, Australia's biggest export, have fallen 30 per cent in the past two months

The price collapse threatens to put a huge hole in federal government company and mining tax incomes and West Australian royalty earnings.

It has also sent share prices of iron ore miners Fortescue Metals Group and Atlas Iron plunging to three-year lows. Rio Tinto shares threatened to fall below $50 yesterday, down $1.21 to $50.54 compared with $68 six months ago.

Prices fell $US4.60 to $US94.80 in their 17th fall of the past 18 trading days.

http://www.macrobusiness.com.au/2012/08/iron-ore-price-assumptions-collapse/

CLSA commodity analyst Ian Roper said even with downgrades to expected new global supply, the market would be oversupplied by 200 million tonnes a year by 2016 as a result of China’s own mines.

Wonder if Barnett has any informed gut feeling about this,to go with his intuition on JPP?

Premier : JPP madness.

http://www.energynewsbulletin.net/storyview.asp?storyid=9636205§ionsource=s0

Logic in our madness

Noel Dyson

Wednesday, 29 August 2012

WESTERN Australian Premier Colin Barnett has used the launch of Technip’s new Perth office to reassure the oil and gas sector there is indeed logic behind his government’s push for the use of James Price Point.

"Gut Feeling" - Intuition (psychology)

ReplyDeleteColin Barnett - “The reason we’re pushing ahead with James Price Point is not from some political standpoint that we’re right and everyone else is wrong,” Barnett said. “It’s an informed GUT FEELING that the Browse basin will be home to not one but possibly two or three projects.

Carl Jung's theory of the ego

His introverted intuitive types were likely mystics, prophets, or cranks, struggling with a tension between protecting their visions from influence by others and making their ideas comprehensible and reasonably persuasive to others—a necessity for those visions to bear real fruit

...The reliability of one's intuition depends greatly on past knowledge and occurrences in a specific area

...Various definitions

Intuition is a combination of historical (empirical) data, deep and heightened observation, and an ability to cut through the thickness of surface reality. Intuition is like a slow motion machine that captures data instantaneously and hits you like a ton of bricks. Intuition is a knowing, a sensing that is beyond the conscious understanding — a gut feeling. Intuition is not pseudo-science.

– Abella Arthur

Intuition (is) perception via the unconscious

– Carl Gustav Jung

INTUITION may be defined as understanding or knowing without conscious recourse to thought, observation or reason. Some see this unmediated process as somehow mystical while others describe intuition as being a response to unconscious cues or implicitly apprehended prior learning.

– Dr. Jason Gallate & Ms Shannan Keen BA

IMPLICITLY APPREHENDED PRIOR LEARNING

http://www.giz-watson.net/2011/http:/www.giz-watson.net/2011/archives/2009/03/12/gorgon-gas-project-barrow-island-adjournment-debate/

HON GIZ WATSON (North Metropolitan) [5.21 pm]: I rise to express my grave concerns about the latest developments in the moves to access and process Gorgon gas via the internationally significant wildlife refuge we know as Barrow Island. My concerns stem from the recent apparent strategic leak from Premier Colin Barnett of the news that the Gorgon proposal is now estimated to be a $50 BILLION project

In April 2003 the project was subject to an environmental, social and economic review, a process I should note was subsequently pilloried for effectively appointing the proponents at their desired location; that is, Barrow Island. At the time, environmental groups were concerned that once the door was open to this project, the footprint would expand and the sensitive island would become more and more industrialised. In fact, I heard today that this A-class reserve, which once claimed to not contain any introduced species, now has 17 introduced species since the increased industrial activity on the island. Around that time, in 2003, the proposal was anticipated to be two trains, or 10 million tonnes a year of a liquefied natural gas project involving an estimated investment of $9 BILLION

...By the middle of 2006 costs had blown out to $11 BILLION, although we now know that blow-out was a small change compared with what has happened since

...The way we are heading we can easily say to this government that will be the end of this highly significant A-class reserve, which is a refuge to significant numbers of species that have become extinct on the mainland. It is an extraordinary island and the fact that the Premier has indicated that we are contemplating such an enormous increase in the industrial activities on that island, despite the fact that in 2003 he suggested that the processing could go to the mainland, is a very worrying trend. I would be interested also to see what the Minister for Environment has to say about her obligations to protect A-class reserves in this state.

WITH HEADLINES LIKE THESE :

ReplyDeletehttp://www.theage.com.au/business/optimism-may-just-be-wishful-thinking-20120830-253h6.html

http://www.theage.com.au/business/falling-fortescue-stands-firm-20120830-253h1.html

http://www.theage.com.au/business/forrest-shores-up-fortescue-with-40m-20120830-253h2.html

http://au.news.yahoo.com/thewest/a/-/newshome/14715789/moodys-flags-fmg-downgrade/

IT'S NO WONDER TWIGGY IS LOOKING AT AFRICA :

http://www.theaustralian.com.au/business/mining-energy/watch-out-for-africa-forrest/story-e6frg9df-1226462015966

MINING billionaire Andrew Forrest has tied his fortunes to selling iron ore to economic powerhouse China but he has called for more competition from Africa, where he sees resources developments lifting locals out of poverty.

DEVELOPMENTS LIFTING PEOPLE OUT OF POVERTY ?

THE AFICANS BETTER SPEAK TO THE ROEBOURNE MOB ABOUT THAT.

HERE WE GO AGAIN !

On $2 a day of course.

Deletehttp://www.smh.com.au/business/world-business/100b-lng-projects-imperiled-by-african-gas-rush-20120831-25428.html

ReplyDeleteThe discovery along Africa's east coast of the world's biggest gas finds in a decade threatens to undo investment plans on the other side of the Indian Ocean.

Royal Dutch Shell, BG Group of the UK and France's Total may scale back projects to build liquefied natural gas export plants in Australia and switch to Tanzania and Mozambique, where the new prospects lie and will cost about half as much, according to Jefferies International.

...Dale Nijoka, an analyst at Ernst & Young LLP, said this month in a report that LNG from East Africa “could become more competitive than unsanctioned Australian LNG projects, causing them to be delayed, re-worked or possibly canceled” over the long term.

...The cost per unit of capacity will be about 44 percent lower in Tanzania than at Pluto LNG in Australia, the most expensive plant built, the bank said.

...There are still 95 trillion cubic feet of gas reserves yet to be discovered in Mozambique and Tanzania, Wood Mackenzie Ltd. said Aug. 22. “There is clearly plenty of gas to supply the likely commercialization route of LNG -- theoretically enough to support up to 16 LNG trains.”

...“East Africa has got potential to be a bigger LNG supplier than for example Australia or Qatar on a much lower cost base,” said Barry Rushworth, the CEO at Australia's Pancontinental Oil & Gas NL, which is drilling now a well off Kenya. “People are just not actually realizing how much potential East Africa has yet.”...

...Planned North American exports are set to add to the competition for Australia after a boom in production from shale reduced U.S. natural gas prices to a 10-year low. Shell has already started talks with Freeport LNG Development LP in Texas, which is aiming to become the second venture to win U.S. approval to export the fuel from the Gulf of Mexico coast after Cheniere Energy Inc.

SO MUCH FOR NEV POWER AND TWIGGY FORREST AND THEIR $120 A TONNE "IRON ORE PRICE FLOOR."

ReplyDeleteTHIS MAKES FOR QUITE A READ.

http://afr.com/tags;jsessionid=2A27571FECB2297369B3137E8529FC72?tag=C_FORTESCUE%20METALS%20GROUP%20LTD-FMG

USED TO BE SO GOOD,NOT SO LONG AGO :

http://investment-income.net/5-6-yield-fmg-resources-3-12-year-yankee-bonds-ba3bb-rated.html

This is an exceptional yield, especially considering its very short 3 ½ year maturity and strong possibility of being called a year earlier. Although FMG’s bonds are rated as Ba3/BB+, we believe they are a savvy risk offering a significantly higher yield from a company that has a good cash position, sound interest coverage, and a flexible balance sheet.

NOW :

http://afr.com/p/business/companies/moody_puts_fortescue_rating_on_review_w0ki9uqDrFOeflJf1motOP

Ratings agency Moody’s has placed Fortescue Metals Group’s Ba3 credit rating on review for a possible downgrade after the iron ore price fell a further $US1.60 a tonne, to $US88.70, on Thursday.

http://afr.com/p/business/companies/fortescue_in_spot_of_bother_over_0sPMUHbhgkHrEmbLXDONEL

The freefall in the iron ore price is no doubt testing some nerves at Fortescue Metals Group – less than a month ago, Merrill Lynch extended the miner $US1.5 billion of debt.

http://www.businessspectator.com.au/bs.nsf/Article/iron-ore-BHP-Rio-Fortescue-Boart-Longyear-steel-Ch-pd20120831-XNSAR?OpenDocument&src=sph

“What about demand? It was going along nicely until about September last year when the combination of the deepening troubles within the eurozone and China’s own internal attempt to stamp out a credit driven property bubble combined to slow its economy. It has kept slowing and, as Europe’s woes have worsened, China’s exports have fallen away sharply – with an obvious and intensifying impact on its steel mills. Conventionally that would drive down steel prices, as it has, produce a significant increase in inventories, which it has, reduce demand for iron ore, which it has, but also lead to reduced steel and domestic iron ore production – which it hasn’t. Steel and iron ore prices have fallen to levels last seen during the worst of the financial crisis but steel production has held up and, it appears, domestic iron ore production, while it has been cut back, hasn’t responded as completely to the price signals as it should have. That’s why the iron ore floor price thesis has broken down.”

http://www.smh.com.au/business/impatient-miners-hijacking-economy-20120902-258ej.html

ReplyDeletePeople have understood the short-sightedness of short-termism for decades, but little or nothing has been done to correct it. Truth is, the business world is shackled by its uncontrollable impatience, to our long-term detriment.

It doesn't seem to have occurred to those people complaining about being in the slow lane of the resources boom that their problems are being compounded by the miners' impatience to get in for their cut while the going's good.

That's because, in business circles, impatience is seen as something to be admired. Among economists, the speed at which market participants wish to proceed is seen as a matter for them in their response to market incentives, not something the government should interfere with.

The more the dollar stays high despite the fall back in coal and iron ore prices, the more likely it's being held up by the huge mining investment boom, as miners rush to get extra production capacity on line before prices have fallen too far.

Miners are elbowing their competitors aside, trying to grab the labour and other resources they need to get their mine built ahead of other people's mines. They're attracting resources away from other industries - including major public infrastructure projects - thus creating shortages of skilled labour and bidding up wages.

This explains why miners are demanding environmental and other approval processes be speeded up. Worry about the environmental consequences later - let's just do it!

And all because no one was prepared to tell the miners our minerals would come to no harm staying in the ground, so they should stop making trouble for others by being so impatient.

THIS SHOULD MAKE FOR INTERESTING READING,HOPE BARNEY RUBBLE IS LOOKING.

ReplyDeletehttp://au.news.yahoo.com/thewest/

LARRY GRAHAM : "We will exit this boom,underskilled,underemployed and with our major industries in decline."

READ HIS COLUMN/ONLY IN THE WEST AUSTRALIAN TOMORROW.

THE HEADLINES LATELY COULDN'T SPELL IT OUT ANY CLEARER.

The first boom,which was to last 20 years,only went 20 weeks before the GFC killed it.

Now we have boom mk 2,which Barnett says isn't a boom - but 20 to 30 years of sustained growth.

This boom is at 20 months.

http://www.theaustralian.com.au/business/economics/steep-asian-downturn-causes-concern/story-e6frg926-1226464058203

ASIA'S manufacturing downturn deepened in August as China weakened sharply, adding to pressure on governments and central banks to do more to prevent a sharper slowdown caused by flagging demand from Western markets.

China's manufacturing sector -- the engine for much of Asia's economy -- slumped further, with activity shrinking at the fastest pace since the depth of the global financial crisis and at a faster clip than preliminary data showed last month.

http://www.theage.com.au/business/mining-and-resources/miners-cut-back-on-exploration-as-prices-slide-20120903-259zn.html

The decline - the first since March 2009 - was driven by weaker spending in the mining boom states of Queensland and Western Australia.

It occurred before the 30 per cent drop in iron ore prices of recent months, with iron-ore exploration rising strongly during the June quarter.

Advertisement

But with iron ore now trading near three-year lows of less than $US90 a tonne, the slide in total exploration is tipped to continue in coming months as drilling for the mineral is put on hold.

http://au.news.yahoo.com/thewest/business/a/-/national/14738622/falling-profits-point-to-slowing-growth/

A fall in company profits for the past three quarters points to a broad-based slowing of the economy in the months ahead.

Ten of the 15 industries in the Australian Bureau of Statistics (ABS) business indicators surveyed showed falls in profits, including mining, manufacturing and retail.

OK,SO ALL CHANGE - DON'T BE FED UP WITH ALL THE NEGATIVE NEWS THAT IS DESTROYING BARNETT AND WOODSIDE'S DYSTOPIAN VISIONS FOR POOR OLD US - NEGATIVE IS THE NEW POSITIVE !!!

http://www.smh.com.au/lifestyle/life/thinking-negative-20120830-251jn.html

The outbreak of cynicism started in the US, the spiritual home of evangelical positivity. Barbara Ehrenreich argued in her book Smile or Die: How Positive Thinking Fooled America and the World that reckless optimism blinded the financial sector to looming catastrophe: ''What was the point in agonising over balance sheets and tedious analyses of risks … when all good things come to those who are optimistic enough to expect it?''

Advertisement

The latest retort to the onslaught of cheerfulness comes from Oliver Burkeman with his book The Antidote: Happiness for People Who Can't Stand Positive Thinking. Burkeman writes a column on mental well-being for Britain's The Guardian newspaper, and is convinced that chasing happiness is a problem. He explores a ''negative path'' to happiness, learning the arts of Stoicism and meditation, how to embrace failure and why it is better to accept than resist insecurity.

SO STAY NEGATIVE GUYS.

A FAST MOVING STORY.

ReplyDeleteChina faces lowest growth in 13 years as economists pare forecasts

by: Michael Sainsbury

From:The Australian

September 04, 201212:00AM

Increase Text Size

Decrease Text Size

Print

Tweet this

CHINA'S economic growth this year could now come in below 8 per cent, its lowest rate for 13 years, as economists continue to pare back their forecasts.

As the world's second-largest economy continues to falter, economic gloom is spreading across the region and any bounce-back is now not expected until the new year, with politics atop Beijing's agenda as it prepares to change leaders.

http://www.smh.com.au/business/the-economy/a-tipping-point-for-the-australian-economy-20120904-25baw.html

Over the past few weeks, sentiment towards Australia and the sustainability of the mining boom has been shifting. While for some time at Macro Investor we've been talking about the fall in bulk commodity prices and the impact this move will have on national income, it's now entered the mainstream consciousness globally.

Advertisement

Everywhere from Financial Times to the Sacramento Bee the talk is that the mining boom is over, that China is not going to stimulate its own economy in the manner it did last time, that the forward-looking indicators of global growth are parlous. Australia has gone in a short space of time from the lucky country to the country whose luck is running out.

But on the main stage we still see business leaders, top commentators and politicians in a tizz, either denying there ever was a mining boom, saying it never mattered anyway, or reassuring us that it will endure for another 20 years.

...

But now, Australia looks dumb: it's hitched its wagon to a flailing Chinese dragon, its got a series of budgetary black holes and its political debate looks as crazy as a Republican primary.

...

Moreover, are Australia's houses good value when a shack in Byron costs more than a flat in Paris? Are Australian wages reasonable when a truckie in Kalgoorlie earns more than a team in Jo'burg? Is Australia's dollar fairly priced when it buys you an ice-cream in Brisbane for the same as a dinner in Singapore?

...

Things look rosy when viewed within the prism of Australia's unique position in the global economic landscape, but look beyond our shores or the last reporting season and confidence looks misplaced or worse.

Just like that fabled moment in time, when the grounds of the Imperial Palace in Tokyo were worth more than the entire real estate market of California, we wonder if a tipping point has been reached for Australia.

http://www.smh.com.au/nsw/tinkler-fails-to-meet-deadline-for-settling-17m-mirvac-deal-20120903-25amp.html

ReplyDeleteCoal prices have slumped recently, putting pressure on Mr Tinkler, who is known to have substantial debts secured against his stake in Whitehaven and other assets including his horseracing empire, Patinack Farm.

The full extent of Mr Tinkler's debts has not been confirmed, but corporate filings indicate his maximum liability may be as high as $638 million although his spokesman said the figure was ''a mere fraction'' of that amount. His Whitehaven shares were worth $696 million yesterday.

The Herald recently revealed Mr Tinkler was facing a ''mutiny'' from Patinack Farm employees who had not been paid their superannuation money since November.

WOULDN'T BE ALL THAT BAD TO SEE KING COAL GO BROKE.

ReplyDeletehttp://www.nature.com/nature/journal/vaop/ncurrent/full/nature11392.html

Ancient Ice Complex deposits outcropping along the ~7,000-kilometre-long coastline of the East Siberian Arctic Shelf (ESAS)4, 5, and associated shallow subsea permafrost6, 7, are two large pools of permafrost carbon8, yet their vulnerabilities towards thawing and decomposition are largely unknown9, 10, 11. Recent Arctic warming is stronger than has been predicted by several degrees, and is particularly pronounced over the coastal ESAS region12, 13. There is thus a pressing need to improve our understanding of the links between permafrost carbon and climate in this relatively inaccessible region

http://au.news.yahoo.com/thewest/a/-/newshome/14746758/fmg-to-cut-jobs-costs/

ReplyDeleteWith benchmark iron ore prices last week dipping below $US90 ($87.87) a tonne - Fortescue receives less than benchmark prices because of the lower grade of its iron ore blends - UBS analysts have speculated that Fortescue's profit margin could have fallen as low as $US9/t.

Moody's Investors Service has already placed Fortescue's debt rating under review for a possible downgrade.

Industry sources said that if Fortescue's profit margins stayed below agreed levels for extended periods - usually the six-month term between debt repayments - it could trigger default provisions under covenants that traditionally accompany loan agreements such as those signed by the miner.

Fortescue was carrying about $US8.5 billion of debt at the end of June, and in early August said it had negotiated an additional $US1.5 billion in credit facilities to cover cost blowouts at its Pilbara expansion projects.

...............

http://au.news.yahoo.com/thewest/a/-/newshome/14745047/jobs-to-go-as-argyle-diamonds-cuts-costs/

Mining giant Rio Tinto is set to slash staff at Argyle Diamonds as part of cost cutting intended to position its flagship Australian diamond mine for sale, or before it is floated on the stock exchange.

The move comes only months before Rio is due to complete work on a trouble plagued $2.2 billion expansion of the mine, famous for its rare pink diamonds.

http://au.news.yahoo.com/thewest/business/a/-/wa/14750365/expert-in-broome-to-hear-browse-appeals/

ReplyDeleteBecause of the large number lodged in Broome, community members have been grouped together for joint discussions about their concerns.

The Office of the Appeals convenor wrote to appellants to say they would have the chance to discuss their concerns in further detail with Dr Green.

It said some appellants had raised common matters of appeal, such as concerns about marine fauna or terrestrial vegetation.

Consultations are invitation only and closed to the public and media.

Dr Green is expected to be in Broome for about two weeks.

Further meetings with appellants from Perth and outside WA will be conducted at the end of the month.

After the consultation, Dr Green will prepare a report for consideration by Mr Marmion which will not be made public until the Minister has determined the appeals.

PROCTOR IN ONE OF HIS MAD PANICS OVER HIS WALLET,AS USUAL,I 'SPOSE IF SOMEONE SAID "LET'S HAVE CARS ON A BIG PERTH BEACH" THE OUTCRY WOULD BE "NO - PEOPLE WON'T GO THERE,TOO SCARED OF BEING RUN OVER" ETC. - BUT THIS IS BROOME.

ReplyDeleteIT WOULD BE A BEAUTIFUL BEACH WITHOUT CARS - ALL THE CRABS WOULD COME BACK AND MANY OTHER THINGS THAT ARE ALL CRUSHED OUT OF EXISTENCE AT THE MOMENT.

http://www.abc.net.au/news/2012-09-05/changes-to-broome-under-scrutiny/4244206

Local Chamber of Commerce president Tony Proctor says restricting car access to the beach would be a bad move.

"The cars on Cable Beach issue it a very sensitive one," he said.

"Looking at it from a commercial perspective, if the town continues to grow, we have to continue to have Cable Beach accessible for the families who go down there to recreate at the various activities they do down there."

He says the international appeal of Cable Beach could be put in jeopardy.

"There are some very complex issues here affecting the future growth in Broome," he said.

"I think the beach issue is a very sensitive one, but looking at it from a commercial perspective, well it will be a pretty bleak future for people living in Broome and for the tourism industry."

YEAH TONY,NOT LIKE THE GAS PLANT EH,AND ALL YOUR OTHER LOUSY PLANS TO STUFF YOUR POCKETS WITH CASH AT THE EXPENSE OF THE REAL BROOME COMMUNITY.

If Proctor is that worried then he should have a long look at all the other destructive things going on.

ReplyDeleteHow about no beach at all?

How about no Broome?

What are these people going to do?

Enjoy snow now . . . by 2020, it'll be gone

by: Sophie Gosper

From:The Australian

September 05, 2012

ENVIRONMENTAL researchers say the end of Australia's ski culture is in sight.

HOW MANY YEARS AWAY?

ReplyDeletehttp://www.theaustralian.com.au/business/mining-energy/bhp-to-invest-635bn-in-petrolumn-as-natural-gas-remains-flat/story-e6frg9df-1226465252848

BHP Billiton says it will spend about $US6.5 billion ($6.35bn) on oil and gas development this financial year, largely to boost oil production from the chiefly shale gas assets it spent $US20 billion on a badly-timed acquisition last year.

The mining giant also gave an upbeat assessment of its West Australian gas assets.

...

Mr Yeager gave a brief but upbeat assessment of the company’s two big undeveloped gas interests off Western Australia – Scarborough, which it owns in a 50-50 joint venture with Exxon Mobil, and the Woodside-operated Browse. Both of these projects are thought to be a long way from a development decision, with many analysts believing they will not be approved in coming years.

“These huge projects will underpin the growth of our LNG exports out of Western Australia in the next two to three decades as they are built and brought on line,” Mr Yeager said.

20 TO 30 YEARS ???

SURELY THAT IS PIPED TO THE NW SHELF,COULDN'T BE ANYTHING ELSE - COULD IT ?

THIS WILL KNOCK A HOLE IN THEIR BOTTOM LINE :

ReplyDeleteSHARP falls in iron ore and coal prices have shaken the Reserve Bank's confidence in China's economy and added to concerns that Asia is being swept into a global downturn.

THE Reserve Bank is becoming increasingly concerned about the slowdown in the Chinese economy and its impact on commodity prices and Australia's terms of trade.

Holding the official cash rate at 3.5 per cent for the third consecutive month yesterday, the central bank noted that the slowdown in China was occurring at a faster pace than expected.

FROM THE AUSTRALIAN.

RUSSIA,IT SEEMS,HAS MORE GAS THAN IT KNOWS WHAT TO DO WITH.

ReplyDeletehttp://barentsnova.com/node/2019

Gazprom endeavours to increase the LNG share in the export portfolio through LNG production and supply from the Russian Far East and the Shtokman project, reads the media message posted by the company today. Gazprom is to extend LNG production and supplies to the domestic market as part of the projects on small and medium-size LNG shipments. Another important step is to enter foreign LNG projects.

SHTOKMAN WAS ANNOUNCED AS CANCELLED INDEFINATELY A FEW DAYS AGO,BUT ONLY BACK BURNER NOW.

http://www.oilandgaseurasia.com/news/p/0/news/16426

Total insisted that the partners involved in the potential development of the Shtokman natural gas field, in Arctic Russia, were still studying the viability of the project but for now had concluded that in the current conditions the costs of development were too high.

In a brief statement, Total, which teamed up with Gazprom and Statoil to develop a LNG project at Shtokman, said it "would like to point out that there has been no decision by partners to postpone Shtokman project sine die."

Total was reacting to reports that Gazprom, which is the operator, has indefinitely postponed the investment decision on Shtokman.

KREMLIN CALLS IN NEW GUY TO OVERSEA SAKHALIN.

http://www.themoscowtimes.com/business/article/fyodorov-appointed-to-oversee-sakhalin-projects/467649.html

Deputy Energy Minister Pavel Fyodorov has replaced Sergei Kudryashov as the government representative at the agency in charge of the Sakhalin-1 oil and gas project, on the supervisory board of the Sakhalin-2 oil and gas project and on the committee responsible for the Kharyaga oil project, Interfax reported Tuesday, citing an order signed by Prime Minister Dmitry Medvedev.

NOT TO BE OUTDONE,THE US OF A IS GOING TO DRILL BABY DRILL.....ON MARS !!!

http://www.pennenergy.com/index/petroleum/display/3504578863/articles/pennenergy/petroleum/offshore/2012/september/offshore-oil_exploration.html

The Washington Post notes that NASA could have more to offer in coming years, with a proposed project to drill into the surface of Mars getting underway.

...

NASA GIVES OFFSHORE AND REMOTE AREAS DRILLING A BOOST.

The National Aeronautics and Space Administration intends to help engineers at a Norwegian robotics company design a system that could reduce the need for on-site personnel at offshore oil rigs, according to Bloomberg.

Robotic Drilling Systems AS has developed a robot capable of completing some of the more monotonous, and often dangerous, work required for offshore oil exploration. The robot will use adaptive thinking programs to respond to conditions, while a highly sensitive, but powerful arm will allow it to manipulate large, heavy components.

The company has signed an agreement with NASA to share information on projects like the recent Curiosity rover that successfully landed on the surface of Mars

JAPAN HAS A FEW IDEAS ON ROBOTS TOO.

Sept 4 (LNGJ) - Mitsui Engineering & Shipbuilding Co. is developing a new undersea energy exploration robot that uses sensors to allow multiple machines to search for signs of natural gas and oil near the ocean floor without colliding, Nikkei reported.

IT WOULD HELP PREVENT THIS

Defusing conflict a valuable skill

Tuesday, 4 September 2012

EMOTIONALLY charged conflicts on offshore installations can turn violent, even deadly, which is why one company is offering courses that teach how to bring about peaceful outcomes.

MAYBE SOMEONE SHOULD TELL GINA,SHE IS VERY IMPRESSED BY AFRICANS WHO WANT TO WORK FOR $2 A DAY,BUT THEY MAY HAVE OTHER DISPUTES AND SCORES TO SETTLE,SO WHY NOT GO WITH THE ROBOTS ?

http://www.abc.net.au/news/2012-09-05/rinehart-says-aussie-workers-overpaid-unproductive/4243866?section=business

DeleteSpeaking in video posted on the Sydney Mining Club's website to discuss the recently signed enterprise migration agreement which will allow her to import 1,700 foreign workers for her Roy Hill Iron Ore project, Mrs Rinehart says Australians should not be complacent about the investment pipeline given that African labourers will work for less than $2 a day.

"Business as usual will not do, not when West African competitors can offer our biggest customers an average capital cost for a tonne of iron ore that's $100 under the price offered by an emerging producer in the Pilbara," she said.

"Furthermore, Africans want to work, and its workers are willing to work for less than $2 per day. Such statistics make me worry for this country's future."

...

Julia Gillard says she does not agree Australia is a difficult place to invest and that she has a different view of how workers should be treated.

"It's not the Australian way to toss people a $2 gold coin and then ask them to work for a day," she said.

"We support proper Australian wages and decent working conditions for Australian people.

"We are not going to have wage rates the same as the wage rates in Africa. We're not going to compete on those kinds of cost differentials.

"We're going to compete on our great mineral deposits, our application of technology and high skills to the task. We mine differently than in other countries."

...

In the video, Mrs Rinehart raised the idea of a "special economic zone" in northern Australia that would have lower taxes and fewer regulations to encourage investment.

"We need to create a large special economic zone in our north, stretching across northern Queensland, northern Western Australia and the Northern Territory, with fewer regulations and taxes, a region that truly welcomes investment and people," she said.

...

SO OK WE IN THE NORTH SUFFER THE DYSTOPIAN NIGHTMARES OF BILLIONAIRES AS THEY HEAD OFF INTO THE SUNSET ON THEIR LEAR JETS AND HUGE BOATS,HATS OFF TO THE KOCH BROTHERS,REX "TILLERMAN",ET AL

BUT IF THE ROLEX MOB HAD THEIR WAY WE WOULD MINE LIKE AFRICAN SLAVES,

Deletehttp://www.theaustralian.com.au/business/companies/regulation-strangling-australian-business-says-warburton/story-fn91v9q3-1226465612841

business still faced a damaging overlap between state and federal regulations.

Business has consistently lobbied the government to remove the duplication, especially in the labour market, which it claims pushes up costs.

Mr Warburton, the former Dupont Australia boss and Reserve Bank board member, who currently chairs the Westfield Retail Trust amongst others, said today that the nation needed to make productivity gains to offset those rising costs.

TROUBLE IS PRODUCTIVITY IS TIED TO SO MANY OTHER BASIC THINGS - LIKE HOW LONG IT TAKES SOMEONE TO DRIVE OR COMMUTE TO WORK,HOW LONG A TRUCK TAKES TO DRIVE 40 KLMS TO FREO WHARF,etc etc

BUT OH THAT $2 A DAY OH YEAH

http://www.theaustralian.com.au/news/breaking-news/australia-ranks-20th-in-competitiveness/story-fn3dxiwe-1226465783220

DETERIORATING workplace relations and inefficient government bureaucracies are holding back Australia's economic competitiveness, a leading industry group says.

The World Economic Forum's (WEF) global competitiveness report for 2012/13 released on Wednesday ranked Australia 20th in a survey of 144 countries, unchanged from the previous year.

...

Since 2010/11, the flexibility of Australia's wage determination system had declined from 110th to 123rd, the effectiveness of the taxation system tumbled from 66th to 103rd and the burden of government regulation slumped from 60th to 96th.

...

THEY DIDN'T SAY HOW THE $2 A DAY MOB WENT IN THIS SURVEY.

LABOUR PARTY - ANYONE FOR CLAYTONS ?

ReplyDeleteTOO MUCH WATER IN THEIR WHISKEY.

HOT ON THE HEELS OF THE VANISHED CARBON PRICE FLOOR :

http://au.news.yahoo.com/thewest/business/a/-/national/14763805/australia-abandons-coal-power-plant-closure-plans/

Ferguson said the government had a set amount of compensation above which it was not prepared to go and there was a "significant difference" between what the companies wanted and how much was on offer.

OBVIOUSLY THE PROBLEM IS WE ARE NOT DETERIORATING (anyone on less than a billion a year of course) FAST ENOUGH.

DeleteHMMM....WONDER HOW MUCH A SLAB IS IN DARKEST AFRICA?

OR AN OZZIE FOR THAT MATTER?

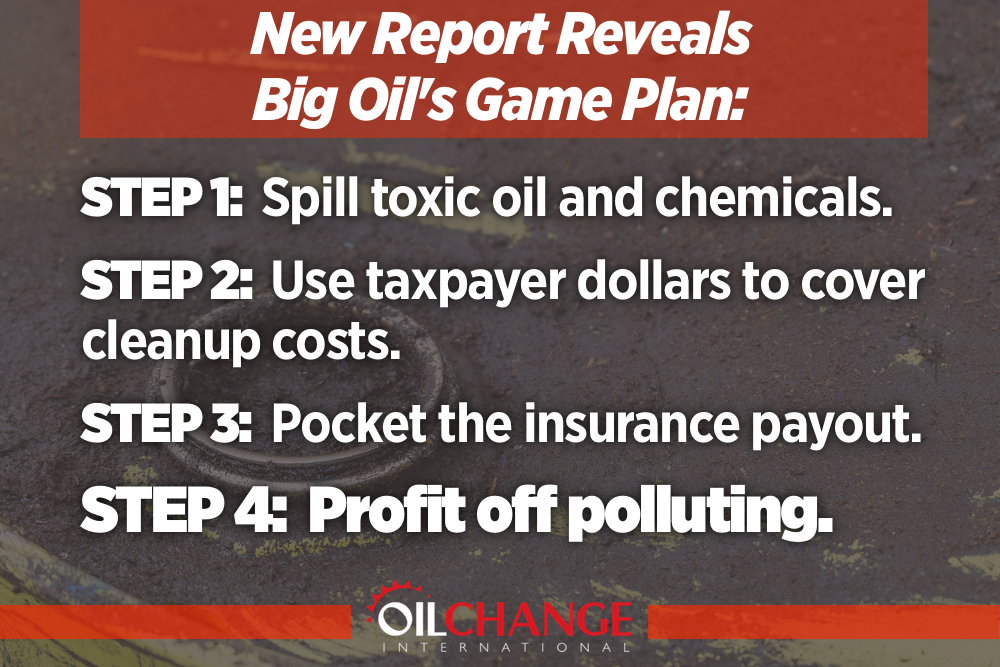

A desciption of BP :

ReplyDeletehttp://www.theaustralian.com.au/business/breaking-news/bp-accused-of-gross-negligence-in-us-spill/story-e6frg90f-1226466120771

It accused the British company of promoting a "culture of corporate recklessness," and of giving the court a "misleading presentation" of the explosion that sank the Deepwater Horizon offshore platform.

"BP did not act alone, by any means, and its gross negligence and willful misconduct are inextricably joined with the acts and omissions of Transocean," it said, referring to the owner of the offshore rig.

But it said: "The behaviour, words, and actions of these BP executives would not be tolerated in a middling-sized company manufacturing dry goods for sale in a suburban mall."

An explosion on April 20, 2010, killed 11 workers and ultimately sank the rig, unleashing the biggest marine oil spill in the industry's history and what many consider the worst US environmental disaster ever.

...

"The court should ignore BP's one-sided argument that the natural resources of the Gulf are undergoing a robust recovery," it said.

"BP's cherry-picked assertions of robust recovery are at best premature judgments on the health of the overall Gulf ecosystem."

AND HERE'S THE PROOF :

http://www.courierpress.com/news/2012/sep/05/bc-us--isaac-oil-1st-ld-writethru128-bp-says-old/

NEW ORLEANS — BP PLC says some oil from its massive offshore 2010 spill along the Louisiana coast was exposed after Hurricane Isaac's scouring waves exposed deposits of buried tar.

Louisiana officials closed a stretch of beach near Fourchon on Tuesday after scouts said they found large tar mats. BP acknowledged Wednesday the oil was from the Deepwater Horizon spill.

Ray Melick, a BP spokesman, said in an email that "as this area has undergone severe coastal erosion by Hurricane Isaac, much of the oil has now been exposed."

He says the company was working with the Coast Guard, state officials and land managers to clean up the exposed oil.

Since Isaac's surge has receded, tar balls and oil have been reported in Alabama and Louisiana on beaches that previously had appeared clean.

DON'T DO AS I DO - DO AS I SAY.

ReplyDeletehttp://www.abc.net.au/news/2012-09-05/rinehart-accused-of-inciting-moral-panic/4245100?section=wa

In lamenting the costs associated with running a business in Australia, Mrs Rinehart pointed out that some African miners work for $2 a day.

The United Nations labour agency estimates there are between 100,000 and 250,000 child gold miners in West Africa.

Australian Council of Trade Unions secretary Dave Oliver says Mrs Rinehart's workforce has been insulted by her comparisons with Africa.

"It took me a bit of time to work out if I was watching a comedy skit or a horror movie," he said.

"It's an insult to all the workers who work for her company.

"It just beggars belief that she is trying to advocate a position where for us to be competitive we have to look at the conditions that we see in third-world countries.

...

One of the most interesting suggestions Mrs Rinehart made was for the creation of a new economic zone for northern Australia.

In her vision, it would have fewer taxes and regulations while welcoming investment.

...

But Professor Buchanan does not think the idea will work.

"It's been pretty well established that this is extremely good for the companies that are involved, but they do very little to leave an enduring infrastructure or benefit to the host nations," he said.

...

MEANWHILE BACK IN THE OFFICE :

http://www.theage.com.au/business/brambles-boss-needs-pallet-for-his-extra-dosh-20120905-25ero.html

Gorman was given a modest 40 per cent pay rise this year, taking the total value of his pay packet from $3.8 million to $5.3 million, according to figures in the annual report Brambles filed with the exchange yesterday.

...

But was Gorman's performance 40 per cent better than the previous year? A company spokeswoman declined to say.

"It just beggars belief that she is trying to advocate a position where for us to be competitive we have to look at the conditions that we see in third-world countries."

DeleteLike Roebourne for example.

https://www.facebook.com/Yindjibarndi/posts/436224873096889

ReplyDeleteUnited Nations envoy told of mining impact on communities

Category: Headline News Published Date

By National Indigenous Times West Australian reporter Gerry Georgatos

The United Nations Indigenous Rights Special Rapporteur, James Anaya has been told by members of the Yindjibarndi clan Fortescue Mining Group was failing to live up to social responsibilities and the company should copy the processes adopted by Rio Tinto in building a strong and mutually beneficial relationship with Australia's Indigenous people.

Mr Anaya is touring Australia to gather information before preparing a report for the United Nations.

He visited Roebourne in Western Australia with the Co-Chairs of the National Congress of Australia's First Peoples, Les Malezer and Jodi Broun.

Roebourne was only one of several communities Mr Anaya visited during his week long tour to gather feedback from the communities on how they felt they were being treated by mining companies.

Mr Anaya heard from local peoples and community leaders in Roebourne that Yindjibarndi peoples continue to live in third world conditions where up to 80 per cent of the town's Aboriginal children suffer from otitis media and hearing loss, that Roebourne Hospital may close, that regional community mobile health clinics were yet to happen, poverty is on the rise and disparity is widening despite the mining boom and the record profits Fortescue has been achieving from mining the land of the Indigenous people.. Roebourne is in the Pilbara - the heart of the mining boom.

Both the National Congress of Australia's First Peoples and the Yindjibarndi Aboriginal Corporation (YAC) told him not all the mining companies were living up to their prescribed social responsibilities.

Mr Anaya was told there were many Aboriginal communities and regions left worse off from mining projects and the mining boom rather than the communities enjoying the benefits of the mining boom.

Mr Anaya has visited Australia before and has been highly critical of the Federal Government failure to address the third world conditions many Aboriginal peoples languish.

He told the Roebourne meeting respect must be given by national and trans-national mining companies to Indigenous peoples.

...

Congress Co-Chair, Les Malezer said he and Ms Broun had decided to escort Mr Anaya around the country to ensure he heard all views about the impact of mining on communities and not just the view of mining industry leaders and favoured stakeholders from Aboriginal communities.

"We want him to hear from everyone, as he has in Roebourne," Mr Malezer said.

"There are some communities where only some people are making money after having made deals that are in their interests rather than in the collective interest.

"He needed to see there are divided groups and communities where agreements were not reached with mining companies and where instead mining was imposed upon the communities. The Congress would rather have these type of disputes go before a mechanism.

"In Roebourne we have heard that hospitals will close even though Roebourne is in the heart of the mining boom

"The royalties and dividends should be flowing back to the towns and communities," Mr Malezer said.

YAC Chief Executive Officer, Michael Woodley met with Mr Anaya, Mr Malezer and Mrs Broun and he described to them the differences between pro-social and anti-social mining companies.

Where Mr Woodley praised Rio Tinto efforts to work to land use agreements with the Yindjibarndi peoples he said the reverse was true of Fortescue who were "short changing the Yindjibarndi people".

Hey Gina check this out

DeleteMr Anaya heard from local peoples and community leaders in Roebourne that Yindjibarndi peoples continue to LIVE IN THIRD WORLD CONDITIONS where up to 80 per cent of the town's Aboriginal children suffer from otitis media and hearing loss, that Roebourne Hospital may close, that regional community mobile health clinics were yet to happen, poverty is on the rise and disparity is widening despite the mining boom and the record profits Fortescue has been achieving from mining the land of the Indigenous people.. Roebourne is in the Pilbara - the heart of the mining boom.

Should make you happy,we're half way there.

Not the first time he has been here either

DeleteMr Anaya has visited Australia before and has been highly critical of the Federal Government failure to address the third world conditions many Aboriginal peoples languish.

http://www.theage.com.au/business/fortescue-circles-the-wagons-20120905-25ers.html

ReplyDeleteTHE WOES OF TWIGGY FORREST.

Analysts have also questioned the sustainability of Fortescue at current iron ore prices, with Morningstar analyst Mathew Hodge asking whether Fortescue was in fact the ''spent force in iron ore'', now that its vulnerability due to its lower-quality product, higher cost of production and significantly high levels of debt was exposed.

''Even if it is a blip [in the iron ore price], if it sustains long enough Fortescue doesn't have the staying power of the majors BHP [Billiton] and Rio [Tinto],'' Mr Hodge said.

The sharp fall in the benchmark iron ore price, which lost another $US2.20 a tonne to $US86.90 a tonne, has been largely triggered by slowing economic growth in China and a crisis in its largely state-controlled steel industry.

...

Shares in Fortescue have nearly halved in the past four months, wiping close to $3 billion off founder and chairman Andrew Forrest's wealth. Yesterday's plunge alone meant a hit of about $300 million to Mr Forrest.

...

He said Fortescue could now withstand the next financial year if the benchmark iron ore price remained above $US83 a tonne, but would need to raise funds or cut more capital expenditure if prices fell further.

But JPMorgan analyst Lyndon Fagan said the spot price scenario ''doesn't look good'' and that even if spot prices remained at current levels of about $US90 a tonne, Fortescue would still face a funding shortfall of $US3.9 billion.

...

THE WOES OF GINA RINEHART.

http://www.abc.net.au/news/2012-09-06/emas-questioned-at-community-cabinet/4245958?section=wa

The Immigration Minister has defended the use of Enterprise Migration Agreements while job cuts are being announced in WA's mining sector.

At a Community Cabinet meeting in Kwinana last night, one person questioned whether the Government would consider cancelling the EMAs made for Gina Rinehart's Roy Hill project.

Ms Rinehart will be allowed to bring in up to 1,700 overseas workers for the construction phase of the project.

Chris Bowen says the EMA provides certainty for the Roy Hill project.

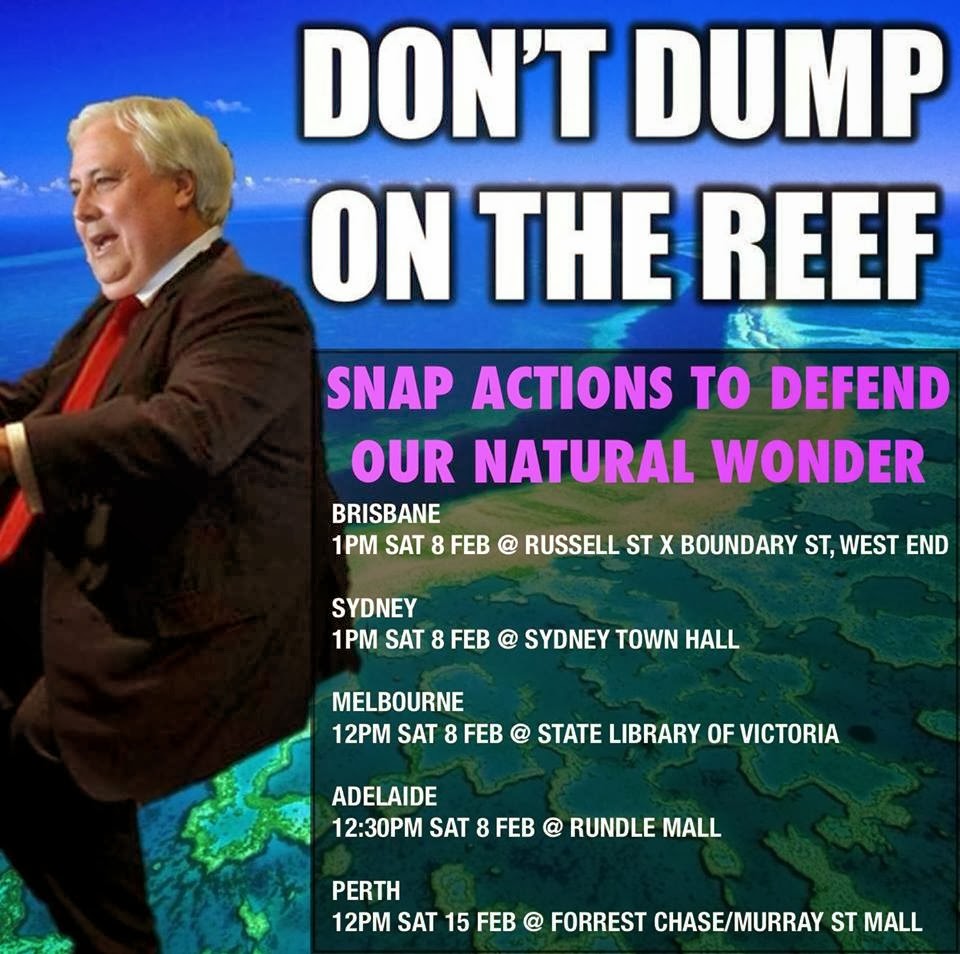

ALL THESE BILLIONAIRES NEED,AND LET'S NOT FORGET TINKLER WHO IS DOWN TO HIS LAST BILLION,AND PALMER WHO NEEDS A BIGGER JET TO FIT HIS GUTS INTO,ARE AFRICANS WHO WANT TO WORK FOR $2 A DAY.

OH,AND ABORIGINALS WHO WANT THEIR COUNTRY DESTROYED FOR NOTHING.

HAD IT WITH THIS MOB AS USUAL.

ReplyDeleteAMATEUR HOUR AT THE KLC AGAIN.

WHY WOULD ANYONE SIGN UP TO SOMETHING THEY DON'T KNOW THE OUTCOME OF?

TOTALLY STUPID BEHAVIOUR.

http://www.abc.net.au/news/2012-09-05/klc-threatens-to-withdraw-gas-hub-support/4245008

The Kimberley Land Council has again threatened to withdraw support for the gas hub, saying the government has still not alleviated cultural and social concerns.

The KLC, which acts on behalf of the traditional owners, says they only agreed to the project on condition the impact would be addressed before it received Commonwealth approval.

...

The KLC's Nolan Hunter says time is running out for that commitment to be made.

"If the project goes ahead and it's approved without those social and cultural impacts being addressed, I think the traditional owners will be forced to reconsider their support for the project," he said.

In a statement, the Premier's office said those impacts are being worked through as part of the Commonwealth's environmental approval process.

AND THEY HAD TO HITCH THEIR WAGON TO THE BIGGEST IDIOT GOING AROUND,THE WARNING SIGNS WERE ALL THERE FROM THE BEGINNING,BUT THEY LOST THEIR HEADS OVER THE BAG OF MONEY AND LIED,CHEATED,DESTROYED COMMUNITY ,LAW AND CULTURE TO GET AT IT.

ReplyDeletePURE UGLY NAKED GREED ON DISPLAY.

BARNETT,AS WE HAVE SAID MANY TIMES,IS GOING TO GET IT - BUT WHEN THE BILL COMES IN WE ALL KNOW WHO WILL HAVE TO PAY UP,AND IT WON'T BE HIS MULTI NATIONAL OR BILLIONAIRE MATES.

IT WILL BE THE COPS,NURSES,ORDINARY WORKERS,AND THE MOST DISADVANTAGED AMONG US AS USUAL.

http://www.abc.net.au/news/2012-09-06/iron-ore-price-drop-places-oakajee-in-doubt/4246214?section=wa

The Shadow Treasurer Ben Wyatt believes the combination casts further doubt about the future of the Oakajee project.

Mr Wyatt says the Premier must confirm that it will actually go ahead.

"What is the future of Oakajee Port?" he said.

"We have $339 million of tax payers money sitting in an account for a project that now has no start date, nor any clear future."

WHAT ABOUT COAL PRICES AND THE FUTURE OF POINT TORMENT?

WHY ARE WE PAYING AS MUCH AS $2 BILLION FOR A FEW THOUSAND EXTRA STADIUM SEATS?

WHY ANOTHER $BILLION? TO PUT A POND AROUND THE BELL TOWER?

THE CANAL(WATER RUNS DOWNHILL FROM THE KIMBERLEY TO PERTH) IS STILL ON THE TABLE.

AND ALL HIS OTHER MADNESS.

Gina can use all the out of work iron ore carriers to transport African slaves and off load them in the Pilbara.Set up the auction block at Roebourne.

ReplyDeleteNo more auction block for me No more, no more No more auction block for me Many thousands gone

No more driver's lash for me No more, no more No more driver's lash for me Many thousands gone

No more whip lash for me No more, no more No more pint of salt for me Many thousands gone

No more auction block for me No more, no more No more auction block for me Many thousands gone

I want a real fine car, fly Miami too

ReplyDeleteAll the rum, I want to drink it, all the whiskey too

My woman need a new dress, my daughter got to go to school

I'm working so hard, I'm working for the company

I'm working so hard to keep you in the luxury

You can't call me lazy on a seven day a week

Make a million for the Texans, twenty dollar me

Yes, I want a gold ring, riding in a limousine

I'm working so hard, I'm working for the company

I'm working so hard to keep you in the luxury

Now listen, I'm a proud man, not a beggar walking on the street

I'm working so hard, to keep you from the poverty

I'm working so hard to keep you in the luxury, oh yeah

I'm working so hard, I'm working so hard

Harder, harder, working, working, working

I think it's such a strange thing, giving me concern

Half the world it got nothing the other half got money to burn

My woman need a new dress, my daughter got to go to school

I'm working so hard, I'm working for the company, oh, yeah

I'm working so hard, oh, yeah

Working on a Sunday in refinery

Make a million for the Texans, twenty dollar me

All the rum, I want to drink it, I got responsibility

I'm working so hard to keep you from the poverty, oh, yeah

I'm working so hard, I'm working for the company, oh, yeah

I'm working so hard, oh, yeah

Harder, harder, working, working...