A MAJOR national bank has been forced to remove more than 100 misleading out of order signs from its ATMs after being targeted by anti-coal activists.

A score of ANZ Banking Group machines sprawled across six capital cities were plastered with "out of order" signs on Sunday after campaigners launched their latest bid to draw attention to the bank's funding of the coal industry.

Photo Damian Kelly

Photo Damian Kelly

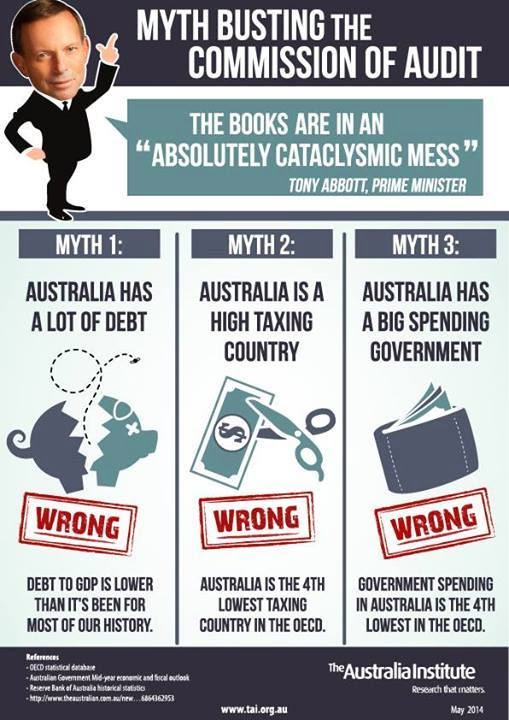

We are so rich but where does all the money go?

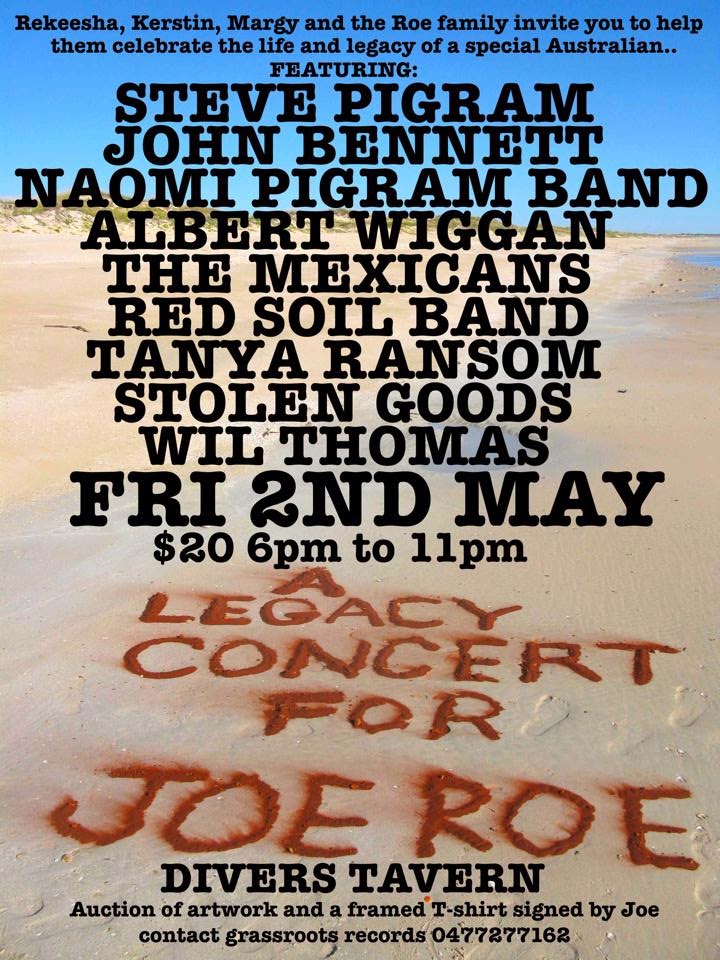

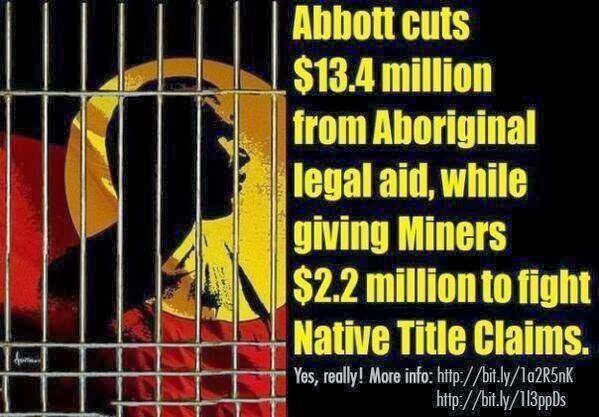

ReplyDeleteIs mining really going to save Aboriginal Australia?

School funding to hit indigenous boarders

THE biggest boarding school for indigenous students in the Northern Territory is considering closing its boarding house this year - leaving 220 students from outback communities stranded - with the principal claiming changes to the federal government's funding arrangements for remote students are to blame.

Kormilda College, an independent school in Darwin, was forced to close one boarding house last year, cutting 80 boarding places for indigenous students, and principal David Shinkfield said the school faces shutting down its boarding facilities by the middle of this year for the remaining boarders.

More workers needed in Canada, but US shale encouraging domestic jobs

ReplyDeleteThe large natural gas boom in the United States is attracting many workers that historically head north to work in the Canadian gas fields. The Financial Post reported this has created a sort of "battle" between U.S. companies and those in Canada fighting for workers.

Gas-drilling companies offer dramatically higher wages in Western Canada, the article stated. While some are drawn by the higher pay, others are choosing jobs domestically. It's expected the rise of shale oil and natural gas in the United States could add more than 1 million jobs to the nation's manufacturing industry.

“You get a big [liquefied natural gas] project that takes place and then you get several of these big refinery projects and then here comes a new ethylene plant,” said Mike Bergen, executive vice president of market based research firm Industrial Info Resources, according to the article. “That’s going to draw a lot of labor.”

The demand for labor workers in Alberta means average wages for electricians, boilermakers, plumbers and pipefitters, carpenters and structural steelworkers can be 70 to 136 percent higher than the median wages seen in the United States, according to the Financial Post. The demand in Canada for industry workers isn't expected to slow down. The article said new developments in Saskatchewan, Ontario and British Columbia will require more workers. Oil sands production is expected to increase 44 percent in the next few years, as well.

...........................

Alaska Aims to Amp Up Natural Gas Exports to Japan

Senator from Alaska will travel to Japan to talk to officials about the state's plentiful natural gas

Republican Alaska Sen. Lisa Murkowski will travel to Japan to discuss natural gas exports and nuclear energy with top government officials this week as the state looks at other markets for its huge supply of natural gas, a spokesman said Monday.

With the recent discovery of massive stores of shale gas in the lower 48 states and the consequent boom in production, the market in the U.S. for Alaskan natural gas has effectively been eliminated. The continent-wide glut has also depressed natural gas prices to the lowest levels in a decade.

But across the Pacific Ocean, a potentially lucrative market for Alaskan natural gas exists. Almost two years after the disaster at Fukushima Daiichi shuttered the island nation's plans for the expansion of nuclear power, all but two of Japan's reactors are offline, making the country's need for alternative fuels greater than ever.

...............................

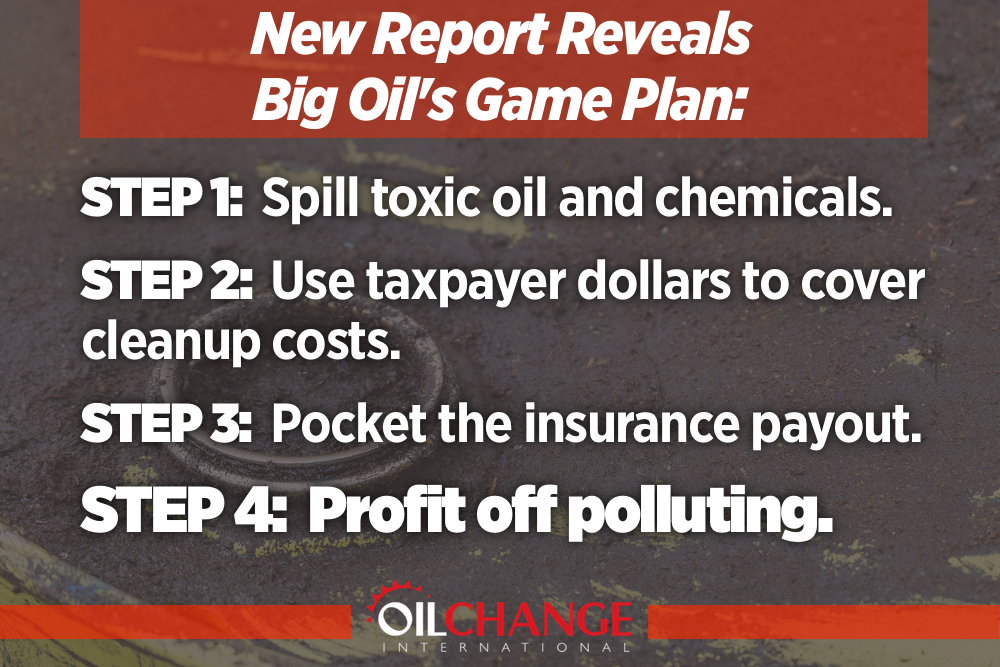

NEW YORK, Jan. 14 /CSRwire/ - Chevron's CEO John Watson and his management team are continuing to publish false and materially misleading information to government regulators and shareholders regarding the enormous risks posed by the company’s failure to pay a $19 billion environmental damages judgment in Ecuador, according to a new report published today.

Written by securities lawyer Graham Erion, the report details how Chevron has “refused to materially amend its disclosure of the risks posed by the final Ecuador judgment” despite a series of devastating setbacks in 2012 to the company’s litigation position in Ecuador, the US, and the three countries where the judgment is in the process of being enforced (Canada, Brazil and Argentina).

“The evidence is clear that under Watson’s leadership Chevron suffers from severe corporate governance problems related to the Ecuador case,” said Erion, who analyzed deficiencies in Chevron’s most recent public filing

The Erion report noted that Chevron has refused to disclose in its securities filings the impact enforcement of the lawsuit may have on the company, despite an internal assessment that the seizure actions will likely cause “irreparable harm” to Chevron and are like the “Sword of Damocles” touching the company’s forehead, according to a statement Chevron lawyer Randy Mastro made in open court.

re Alaska and the worldwide skill shortage :

DeleteA MASSIVE 40,000 to 50,000 people may find work thanks to a mini North Sea renaissance, according to a new report.

Analysis from oilandgaspeople.com said that a record-breaking recent licence round, where 167 new licenses were handed out, would drive new employment in the sector.

In the past few months alone, UK Stat Oil has announced a £4.3 billion investment into North Sea oil, which should create over 700 jobs, while a Talisman Energy-Sinopec joint venture recently announced a £1 billion spend in the region.

However, the high demand may not necessarily equate into new jobs, with skills shortages in the sector threatening to derail the bullish predictions.

The UK oil and gas sector has experienced a talent crush in recent years, with experienced workers heading to other climes while older workers were leaving altogether.

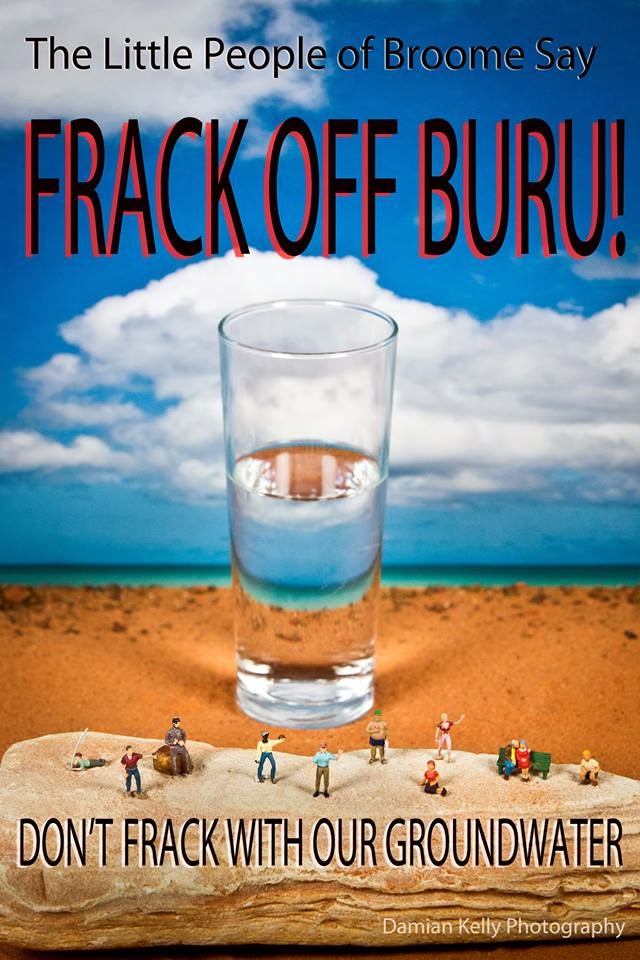

However, with onshore exploration opening up due to a lifting of the moratorium on hydraulic fracturing, the drain may get worse.

Fortescue Metals Group has terminated a proposed deal that would have seen the company diversify into Western Australian shale gas.

ReplyDeleteLess than two months after shale minnow Oil Basin Limited claimed to have secured Fortescue as a cornerstone investor and new biggest shareholder, Oil Basins conceded on Tuesday that Fortescue had walked away from the proposal.

Cancellation of the proposed deal does not come as a massive surprise, given it was behind schedule and had attracted the attention of Australia's corporate regulator in relation to movements in the Oil Basins share price prior to it being announced.

Suspicions that the deal may not go ahead started to grow when it was not finalised within five business days as flagged by Oil Basins.

Finally today, Oil Basins released a statement to the ASX confirming that Fortescue would not become its cornerstone investor.

"OBL advises that on 14 January 2013, discussions on the letter of intent were terminated by Fortescue," said the statement from Oil Basins chief executive Neil Doyle.

Oil Basins claimed that Fortescue remained interested in acquiring some acreage in the area - known as Derby Block - should it be awarded to Oil Basins by the WA Mining Minister.

Fortescue shares were 1.9 per cent lower at $4.63, while Oil Basins remained in a trading halt

Rig and service personnel are expected to mobilise to the Cyrene-1 site at EP 438 in the Canning Basin during the course of the week.

ReplyDeleteKey Petroleum told the market this morning that the well had an estimated conventional resource of 5 million barrels of recoverable oil.

........

No one knows what is going on with Browse,not even Kellogg,Brown & Root.

KBR chief executive William Utt “I don’t think that we in the EPC space really know what’s going on between the sponsors of the project and the government so we remain interested and watch,” he said.

Shell is also thought to be pushing for its FLNG technology to be used at the field.

It has bumped up its stake in the Browse joint venture in the past six months and has been out and about spruiking the technology’s potential.

However, it is thought the JV must put together a proposal for an onshore LNG plant before it can start to consider alternatives.

...............

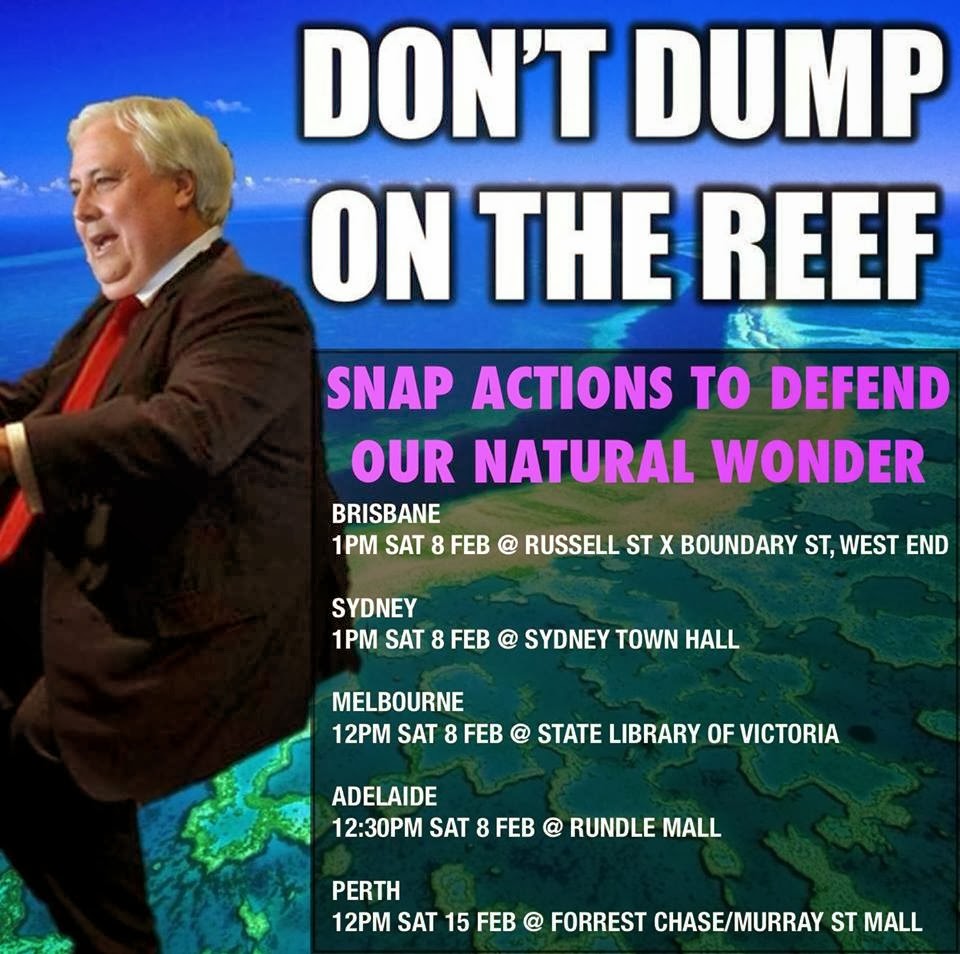

Barnett told major players Woodside and Shell he would not let them abandon James Price Point in favour of a floating offshore processing plant.

It was reported the project was not economically viable and the decision to switch to a floating LNG processing plant would be cheaper considering the current market.

..............

I would have thought the dispute would be over BP's claim to have "recovered" this much oil.

BP told the New Orleans court it was seeking a ruling that the 810,000 barrels of oil that had been captured could not be liable for the Clean Water Act penalties – which could amount to $US4300 ($A4077) per barrel if the polluter was found to have been negligent.

.............

Jostling for elbow room in the Eastern Med.

Turkey has overtaken Norway as the region’s biggest oil producer to fuel their rapidly expanding economy, according to Bloomberg.

The country now has more rigs than any other European country at 34, eight more than at last count on December 31.

New rules are set to speed up the search for oil and gas.

......................

Armour Energy has thrown a spanner in the works in the ongoing negotiation to supply gas to the Gove aluminium refinery in the Northern Territory by suggesting it would be able to meet the requirements of the plant more easily than some of its bigger counterparts.

Executive chairman Nick Maher said Armour could meet the required 30 petajoules over 20 years starting in 2015 handsomely.

“The fact is that our Glyde gas discovery last year is both the closest and the biggest to Gove yet, so from a geological point of view and a logistical point of view we would say our project made more sense than any others.”

..................

“We expect LNG carrier spot rates to ease slightly in 2013 – but generally stay at healthy levels – as the rapid rate upside following the Fukushima nuclear disaster continue to plateau and as the global carrier fleet starts to grow in advance of a major liquefaction inflection point in 2015/16,” Wells Fargo analyst Michael Webber said in a report, according to the news wire.

....................

Prosecutors for the US state of New Hampshire have alleged that Exxon knew adding methyl tertiary-butyl ether to gasoline to make it burn more thoroughly would triple the likelihood of groundwater contamination, according to Bloomberg.

The comments were made by prosecutors during their opening statement in a trial which is seeking $800 million worth of damage from the major for environmental damage.

“In 1984 Exxon anticipated that if it added MTBE to its gasoline the number of contamination incidents would triple.

“These incidents would take longer to clean up and cost five times as much.”

The state said it had identified 229 sites that would require clean-up from contamination by MTBE which, according to court filings, can cause cancer in animals.

It said tests in 2005 and 2006 showed MTBE in 9.1% of private wells throughout the state.

WHITE LOANS

ReplyDeleteWindsor House, Greville Road,

Bristol, BS3 1LL United Kingdom.

Email: whiteloans@admin.in.th

White Loans is a trading name of Freelancer Financials Ltd, Avondale House, 262 Uxbridge Road, Middlesex, HA5 4HS.

Company Number: 07676401.

Data Protection Number: Z2957996.

CCL Number: 562464

We specialise in finding short/Long term credit solutions for customers in the hurry. The instant payday loans available through this contact can be arranged online without deposit of valued asset.

It can occasionally take up to three working days to have the funds cleared, depending on who you bank with. Most mainstream banks however are extremely quick at allowing you to access the funds.

Our service is available to you at 2% interest rate. We do however receive commission from payday lenders and brokers when customers enter into a consumer credit agreement with the them, having been introduced via our service.

Specialize in offering:

*Refinance

*Home Improvement

*Investment Loan

*Auto Loans

*Debt Consolidation

*Business Loans

*Personal Loans

*International Loans.

Applying for a payday loan through White Loans couldn’t be easier. Simply choose how much you’d like to borrow and when you intend to pay it back.

If you really acknowledge this content, you are to send the details information to the account overleaf.

EASY WAY TO APPLY.

(1) Full Name:

(2) Loan Amount Needed:

(3) Duration of Repayment:

(4) Country:

(5) Marital Status:

(6) Gender:

(8) Age:

(9) Occupation:

(10) Mobile:

Email: whiteloans@admin.in.th

Tel: +447042035199

CUSTOMER CARE

Enjoy Online Banking Services.